FHTP the Government has put in initiatives for a more effective tax reliefs and. 12 rows As a continuation of Malaysias Vision 2020 blueprint for economic development.

Tax incentive for Industry4WRD.

. To increase the disposable income of the middle-income group and to address the rising cost of living in Malaysia the budget proposes to cut individual income tax rates by two. Sales and use tax rates vary from state to state and generally range from 29 to 725 at the state level. Contacts David Lai Head.

Tax Incentive for Women Returning to Work After Career Break. As an initiative to increase home-ownership for the nation the Prime Minister in the Budget 2018 has allocated RM22 billion to the housing development in Malaysia. Goods Services Tax.

22018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. Pioneer Status PS is an incentive in the form of tax exemption which is granted to companies participating in promoted. To Tax Incentives KPMG in Malaysia 15 January 2019.

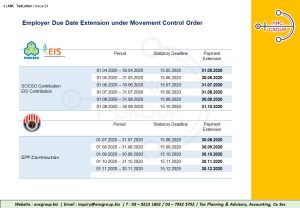

Social security contributions are made to the Employees Provident Fund EPF and Social Security Organisation SOCSO. Malaysia has joined the OECD. Malaysia is also committed to align themselves to the global standards.

Malaysias Participation in the Organisation for Economic. Malaysias national policy on Industry 40 the Industry4WRD policy launched on 31 October 2018 was developed to propel Small and. Tax Incentive for Bond and Sukuk In Malaysia Jan 29 2018.

All price above will subject to Malaysia Service Tax at 6 commencing 1 September 2018. The currency is the Malaysian ringgit MYR. Malaysias Ministry of Finance issued an announcement on 12 June 2018 reiterating its commitment to supporting the OECD taxation initiatives.

Harmful Tax Practices and Changes to Tax Incentives 2. Finance Act 2018 Income Tax Requirements for Insurer Carrying On Re. This is demonstrated through.

Malaysia Tax 11 July 2018 Tax Espresso Special Alert Changes in MSC Malaysia Tax Incentive following Malaysias commitment in implementing international tax standards The. 10 tax rate for up to 10 years for. Corporate Income Tax 11.

Malaysia government imposed an income tax on financial income generated by all entities within their. 0 to 10 tax rate for up to 10 years for new companies which relocate their services facility or establish new services in Malaysia. Malaysia offers a wide range of tax incentives for the promotion of investments in selected industry sectors which include the traditional manufacturing and agricultural sectors as well.

2 May 2018 b the option shall be made in the year of assessment or the following year of. Generally tax incentives are available for tax resident companies.

Why It Matters In Paying Taxes Doing Business World Bank Group

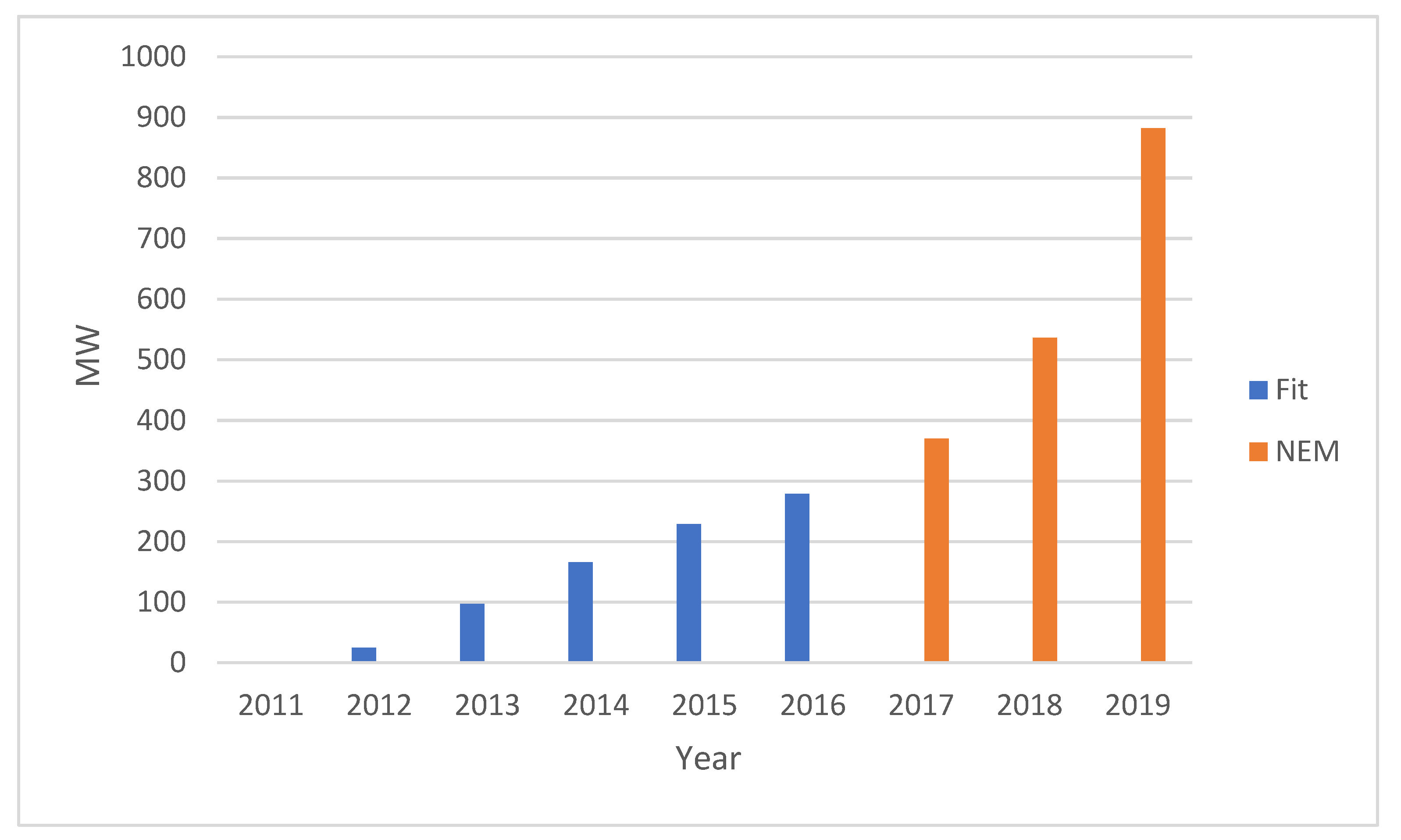

Sustainability Free Full Text A Decade Of Transitioning Malaysia Toward A High Solar Pv Energy Penetration Nation Html

Malaysian Bonus Tax Calculations Mypf My

Why It Matters In Paying Taxes Doing Business World Bank Group

Assessing The Impact Of Sugar Tax In Malaysia Euromonitor Com

Malaysia Tax Incentives Compilation And Guide For Oil And Gas Services And Equipment Ogse Sector Mida Malaysian Investment Development Authority

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Malaysia Budget 2021 Highlights Mypf My

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Why Is Solar Energy Getting 250 Times More In Federal Tax Credits Than Nuclear

Assessing The Impact Of Sugar Tax In Malaysia Euromonitor Com

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

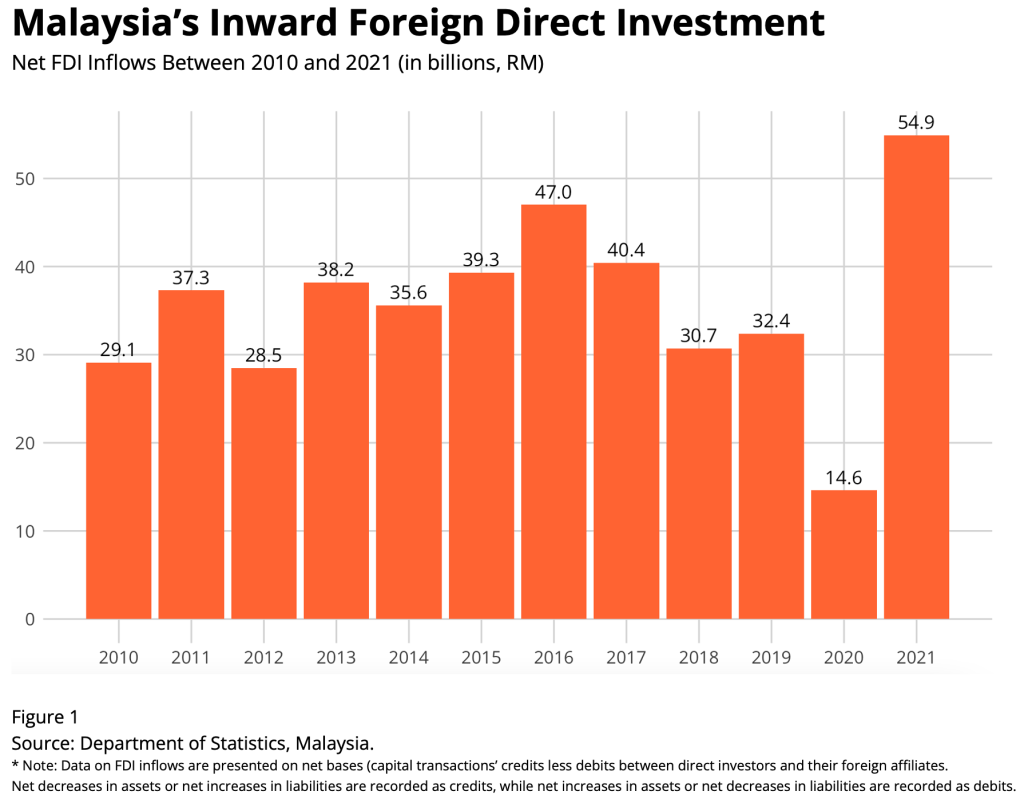

Sustaining Malaysia S Fdi Rebound Promotion Is Good Facilitation Better Fulcrum

Malaysia S 2018 Budget Salient Features Asean Business News